Bitcoin Is the Most Popular Coin in Nigeria

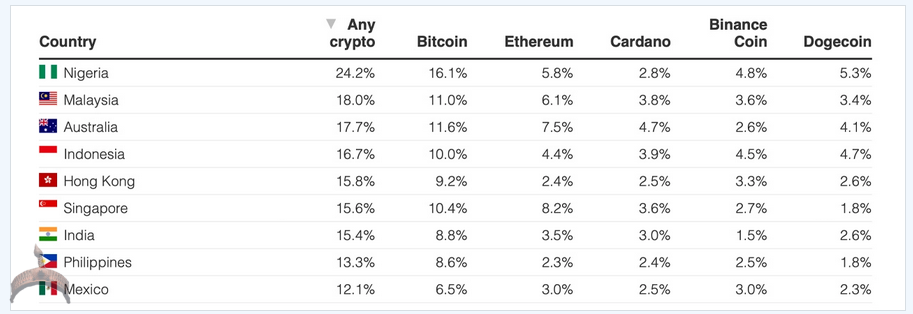

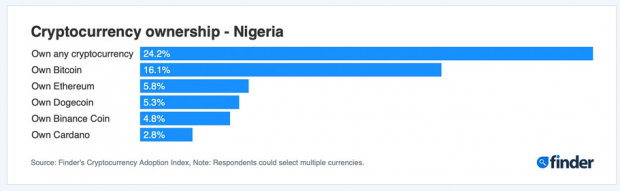

In addition to finding the West African nation as the country with the highest proportion of citizens that hold cryptocurrencies globally, the survey also discovered that “of the 1 in 4 online adults in Nigeria who own some form of cryptocurrency, bitcoin is the most popular coin in Nigeria at 66.5% of crypto owners.” Alternatively, this means more than half of the 24.2% of Nigerian respondents that own cryptocurrencies are in fact bitcoin holders.

On the other hand, the survey findings suggest ethereum (ETH) is the second most popular coin with Nigerian cryptocurrency holders, at 23.8%. Despite this seemingly high rate of interest in ETH, the ratio of Nigerians holding this cryptocurrency relative to other countries is still lower, the survey data suggests.

In fact, according to the survey, the 23.8% ETH ownership ratio is only enough to see Nigeria being ranked the 15th country out of a total of 22 countries.

Dogecoin in Third Place

Meanwhile, the survey findings show the meme coin, dogecoin, in third place at 21.8%. This ratio in turn is enough to see Nigeria feature in the top ten. The survey report explains:

Dogecoin is the third most popular choice with crypto adopters in Nigeria, with 21.8% of adults who own crypto holding the coin. This makes it the 8th ranked country in our list of 22 countries in terms of dogecoin ownership among those that own crypto.

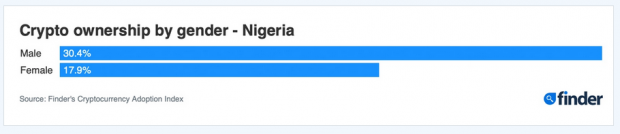

In terms of the makeup of cryptocurrency owners in Nigeria, the survey found 62.9% of Nigerian crypto owners to be men while women account for the remainder.

In other words, this disparity between the number of males and females that own crypto means men are 1.7 times more likely to own crypto. With the average figure globally at 1.5, this means Nigeria has the 11th highest male dominance of the 22 countries.